Calculate bond yield

Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator. See How Finance Works for the formulas for bond yield to maturity and current yield.

Excel Optimal Hedging Strategy Template Optimization Risk Aversion Excel Templates

As this metric is one of the most significant.

. The calculator uses the following formula to calculate the current yield of a bond. Bond Current Yield Calculation. The main types of bond yield.

Worrying about running out of money in retirement can limit your plans. Lets take the following bond as an example. The bond yield can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvesting the coupons at.

It is calculated considering the present value future value coupon payment and. If you are considering investing in a bond and the quoted price is. Yield to maturity YTM is similar to current yield but YTM accounts for the present value of a bonds future coupon payments.

To calculate the current yield of a bond in Microsoft Excel enter the bond value the coupon rate and the bond price into adjacent cells eg A1 through A3. Return Rate CAGR. Calculate either a bonds price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator.

Ad Understand The Potential Returns You Might Receive From Investments. A bonds yield refers to the expected earnings generated and realized on a fixed-income investment over a particular period of time expressed as a percentage or interest rate. Yield to maturity YTM is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity.

First Ill remind you of the basic kinds of rates or yields then well look at how to calculate them. Sign Up and Learn How to Diversify. CY C P 100 or CY B CR 100 P.

In order to calculate YTM we need the bonds current price. C Coupon rate. N 1 for.

Download The Definitive Guide to Retirement Income. Ad Have a 500000 portfolio. CY is the current yield C is the periodic coupon payment.

Yield To Maturity YTM Yield to maturity is an investors expected return after keeping the bond until the maturity date and it includes all the bonds coupon payments. The algorithm behind this bond yield calculator takes account of these variables. There are three main yields applicable to dated.

The current yield of bonds determines the ratio of the interest rate of regular payments to the purchase price of the bond. The formula is very simple and looks like. Calculate the value of a paper bond based on the series denomination and issue date entered.

Mathematically it is the discount rate at. Bonds are priced to yield a certain return to investors. The yield to maturity calculator YTM calculator is a handy tool for finding the rate of return that an investor can expect on a bond.

Ad Three Reasons to Choose Fixed Income. Calculate the bond yield. In cell A4 enter the.

The algorithm behind this bond price calculator is based on the formula explained in the following rows. To calculate a value you dont need to enter a serial. Other bonds can calculate a pre-tax yield so that it matches the tax-free yield of the municipal bonds.

This makes calculating the yield to maturity of a zero coupon bond straight-forward. It is termed the tax-equivalent yield YTM. Yield to Call YTC This is the effective rate.

The Savings Bond Calculator WILL. N Coupon rate compounding freq. Bonds coupon rate interest rate.

For our first returns metric well calculate the current yield by multiplying the coupon rate by the par value of the bond 100 which is then divided by. F Facepar value. Bonds current clean price is the market selling price today.

Bond yield is the implied return on a bond investment assuming investors hold the bond to maturity. A bond that sells at a premium where price is above par value will have a yield to maturity that is lower than the.

Yield To Maturity Ytm And Yield To Call Ytc Bbalectures Com Maturity Business Articles Call

Gcse Ocr Chemistry Chemistry Reaction Balanced Chemical Equation Complete Revision Summary Video Gcse Chemistry Chemical Equation Chemistry Education

Pin On Chemistry

Excel Formulas For Accounting And Finance Basic Excel Tutorial Excel Formula Accounting And Finance Excel Tutorials

Frm Calculate Forward Given Spot Rate Spots Calculator Finance

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

Microsoft Excel Bond Yield Calculations Microsoft Excel Coupon Template Excel

Excel Yield Function Double Entry Bookkeeping

Pin On Fin

How To Calculate The Yield Of A Zero Coupon Bond Using Forward Rates Bond Calculator Really Cool Stuff

Why Lebron James Is Grossly Undervalued From An Economic And Present Val Lebron James Lebron James

Pin On Ch 4 Bond Valuation

Free Online Altman Z Score Calculator At Www Investingcalc How To Get Rich Investing Money Investing

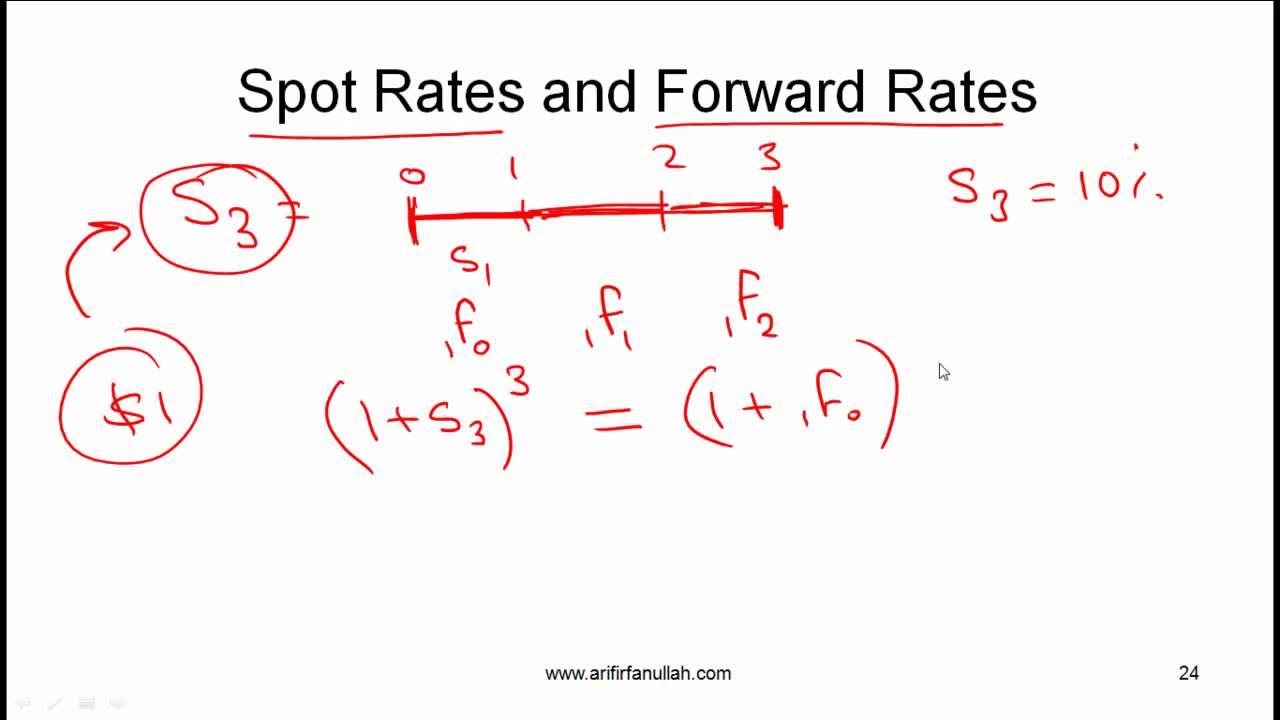

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Bond Yield Calculator Online And Free Www Investingcalc Bond Yield Calculator Free Coupon Rate Current Yield Investing Money How To Get Rich Bond

Bond Yield To Maturity Calculator Printer Driver Organization Development Printer

The Flippening Is Coming But Not The One You Think Thinking Of You The One One